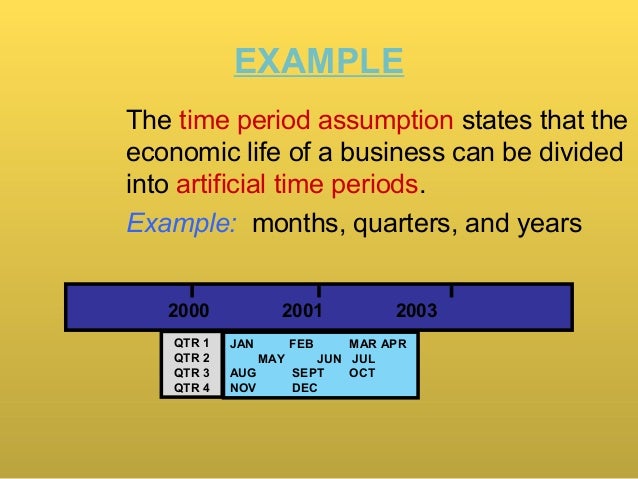

Accountants must balance the need for periodic reporting with the goal of presenting a fair and complete picture of an organization’s financial health. The concept of the time period assumption is pivotal in accounting as it dictates that financial activities can be divided into artificial time periods for reporting purposes. This assumption is crucial because it allows businesses to measure performance and financial status in shorter, more manageable intervals rather than over the entire lifespan of the company.

Ask Any Financial Question

- Debitoor invoicing software aims to help you comply with accounting principles by using an automated system to match your transactions as easily and quickly as possible.

- It depends on what information you are trying to represent with your company’s revenue and expenses.

- In these cases, the transactions and the period need to be estimated to a specific time period.

- In other words, events and transactions that could not be assigned with a monetary value is not recorded in the financial statements.

- This occurs so that the amounts in these accounts reflect only the activity for the current year.

It enables the division of the complex, ongoing financial activities of a business into shorter periods such as months, quarters, or years, which can then be reported and analyzed independently. This division is not just a matter of convenience; it is a requirement for compliance with accounting standards and regulations. You may want to try using one method for all of your financial reporting or only change the time frame when it makes sense, like if there is a significant difference between revenues and expenses during certain months. It’s best to try different methods to see your company’s information when making financial reporting decisions.

The Rules Followed by Accountants When Preparing Financial Statements

The precise time period covered is included in the heading of the income statement, statement of cash flows, and the statement of stockholders’ equity. The income statement tells interested parties how profitably the company has carried out its operations during the period and balance sheet discloses the financial position of the business at the end of the period. This assumption is crucial because it provides a structured framework for reporting, which in turn facilitates analysis, comparison, and decision-making. From the perspective of a financial analyst, the time period assumption is indispensable for trend analysis and forecasting.

Company

Investors and analysts, on the other hand, still rely heavily on periodic reports to assess company performance. However, they are increasingly supplementing these reports with alternative data sources that provide more current insights into a company’s operations and financial health. Business leaders and managers are also reconsidering the time period assumption in light of the demand for more timely and relevant financial information. The rise of big data analytics allows for more dynamic and predictive financial analysis, which could shift the focus from historical reporting to forward-looking financial insights. It is stated that the total revenue is $100 million, but there is no information provided regarding how it was collected or which months were particularly successful or failed.

Time period principle – What is the time period principle?

A vineyard, for instance, aligns expenses such as planting and harvesting with the sales of the wine produced, even though these processes span different accounting periods. Investors also benefit from this assumption as it provides them with regular updates on a company’s financial health, allowing them to make timely investment decisions. A savvy investor might use annual reports to analyze a company’s year-over-year growth and decide whether to buy, hold, or sell their shares. Consider a company that decides to change its fiscal year-end from December 31st to March 31st to better align with its business cycle. This change would require an interim financial statement covering the three-month transition period, which would then be used to adjust the comparisons in subsequent annual reports.

It requires a careful balance between providing timely information and ensuring that revenue is recognized in accordance with the economic realities of business transactions. This synthesis not only affects the preparation of financial statements but also influences the decisions of managers, investors, and other stakeholders who rely on this information. These examples highlight how the time period assumption is crucial in dealing with the complexities of business transactions that span multiple periods.

This cycle culminates in the production of an annual report, which is often audited by independent accountants to ensure accuracy and compliance with Generally Accepted Accounting Principles (GAAP). From a managerial standpoint, the timing of medicare surtax on wages and self revenue recognition can influence business decisions and strategies. Managers may opt to accelerate or delay the delivery of goods and services to align with financial targets or reporting periods, a practice known as ‘earnings management’.

Traditionally, revenue recognition was a straightforward process, but with the advent of new business models, especially in the technology sector, the lines have become blurred. Companies now offer bundled services, subscriptions, and licenses that extend over multiple reporting periods, necessitating a more nuanced approach to revenue recognition. This occurs so that the amounts in these accounts reflect only the activity for the current year. If a company did not complete this process, then the amounts in the revenue and expense accounts could relate to previous years and would not provide the owner with relevant information for the current year. Businesses and other economic entities compile and record transactions using one of the several accounting bases that best meet their needs and preferences. Each accounting basis may be seen as a collection of principles and rules that describe how accountants should record transactions when utilizing that basis.

Zaragoza Company accumulates the following adjustment data at December 31, 2020 Services performed but not recorded total $1,000. A review of the ledger of Remina Company at December 31, 2019, produces the following data pertaining to the preparation of annual adjusting entries. From a managerial standpoint, this assumption aids in setting performance targets and budgets. Managers can evaluate the performance of different departments or projects within these set time frames, making adjustments as necessary to improve efficiency and profitability. It is a very straightforward example, which we try to illustrate the concept of the matching principle.